How Blockchain is Changing the Financial Industry

Blockchain is changing the way money moves. It offers a secure and transparent way to handle transactions. Unlike traditional banks, blockchain does not rely on a central authority. This makes financial transactions faster, cheaper, and safer.

This guide explains how blockchain works and how it is improving finance. It covers its benefits, challenges, and future impact on businesses and individuals.

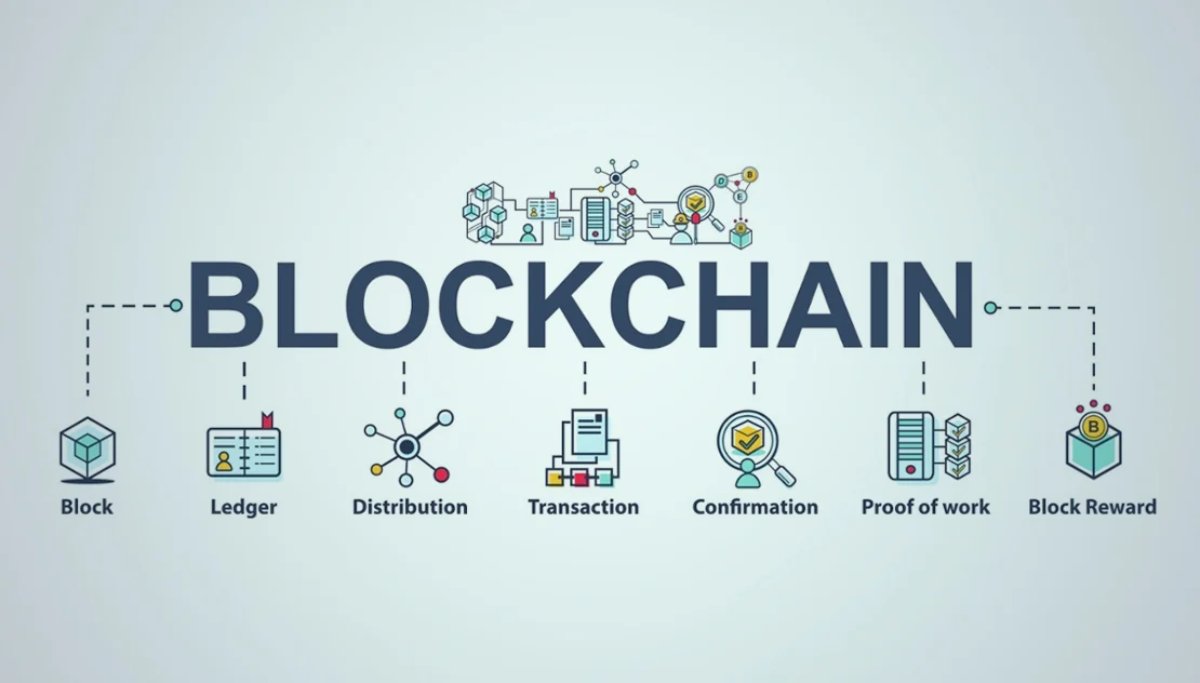

What Is Blockchain?

Blockchain is a digital ledger that records transactions. It stores data in “blocks,” which are linked together. Once a block is added, it cannot be changed. This makes blockchain secure and reliable.

Key Features of Blockchain:

- Decentralisation: No single authority controls it.

- Transparency: Transactions are visible to everyone on the network.

- Security: Data is encrypted and safe from hacking.

- Immutability: Once recorded, transactions cannot be altered.

Types of Blockchain

Public Blockchains

- Open to everyone.

- Used by cryptocurrencies like Bitcoin and Ethereum.

- Fully decentralised but slower.

Private Blockchains

- Restricted to selected users.

- Used by banks and businesses.

- Faster and more private but less decentralised.

Consortium Blockchains

- Controlled by multiple organisations.

- Common in supply chain management and banking.

- Offers both privacy and partial decentralisation.

How Blockchain Is Used in Finance

1. Secure and Transparent Transactions

- Reduces fraud by keeping permanent records.

- Every transaction is verified before being added to the blockchain.

- No need for middlemen like banks or payment processors.

2. Smart Contracts

- These are digital contracts that execute automatically.

- They reduce paperwork and remove third parties.

- Used in industries like insurance, real estate, and supply chains.

3. Decentralised Finance (DeFi)

- DeFi platforms offer banking services without traditional banks.

- Users can lend, borrow, or invest without intermediaries.

- Popular platforms include Uniswap, Compound, and Aave.

4. Faster and Cheaper Cross-Border Payments

- Traditional international payments are slow and costly.

- Blockchain enables instant transfers with low fees.

- Ripple’s XRP Ledger is an example of a blockchain payment system.

5. Improved Financial Inclusion

- Blockchain helps people without bank accounts access financial services.

- They only need an internet connection to send or receive money.

- This is useful in developing countries.

6. Tokenisation of Assets

- Real-world assets like real estate and stocks can be converted into digital tokens.

- Allows for easier buying, selling, and fractional ownership.

- Increases liquidity and investment opportunities.

7. Fraud Prevention in Banking

- Banks use blockchain to verify customer identities.

- Prevents identity theft and fraudulent transactions.

- Reduces the risk of money laundering.

8. Blockchain for Auditing and Compliance

- Creates a transparent and unalterable record of financial transactions.

- Helps businesses comply with tax regulations and audits.

- Reduces accounting fraud and errors.

9. Blockchain-based Crowdfunding and Fundraising

- Allows startups and businesses to raise funds using cryptocurrencies.

- Reduces reliance on traditional fundraising methods.

- Increases transparency for investors.

10. Microtransactions and Low-Cost Payments

- Enables small transactions without high processing fees.

- Beneficial for online content creators and digital services.

- Helps businesses in developing economies accept digital payments.

11. Blockchain for Remittances

- Reduces the cost of sending money internationally.

- Transactions are processed faster than traditional remittance services.

- Helps migrant workers send money home with lower fees.

Challenges of Blockchain in Finance

1. Regulation Uncertainty

- Governments are still figuring out how to regulate blockchain.

- Different countries have different rules for cryptocurrencies.

- New regulations could impact blockchain adoption.

2. Security Risks

- Smart contracts can be hacked if not coded properly.

- Some DeFi platforms have lost money due to security flaws.

3. Scalability Issues

- Some blockchains struggle with slow transaction speeds.

- Ethereum, for example, can get congested, leading to high fees.

- Solutions like Ethereum 2.0 aim to fix this problem.

4. Energy Consumption

- Mining cryptocurrencies require high computational power.

- Proof of Work (PoW) blockchains consume a lot of energy.

- More eco-friendly solutions like Proof of Stake (PoS) are emerging.

5. Lack of Awareness and Adoption

- Many businesses and individuals still do not understand blockchain.

- Financial institutions need to educate users for widespread adoption.

Future of Blockchain in Finance

1. Central Bank Digital Currencies (CBDCs)

- Governments are creating digital versions of their currencies.

- Examples include China’s Digital Yuan and the European Digital Euro.

- These could make payments faster and more secure.

2. Artificial Intelligence (AI) Integration

- AI could improve fraud detection and risk management.

- Combining AI with blockchain could make financial systems smarter.

3. Better Scalability Solutions

- New technologies like layer-2 solutions will speed up transactions.

- The Lightning Network for Bitcoin is an example.

4. Blockchain in Stock Trading

- Traditional stock trading takes days for settlement.

- Blockchain could enable instant trade settlements.

- Reduces costs and improves efficiency for investors.

5. Digital Identity and KYC Compliance

- Blockchain could revolutionise how identities are verified.

- Users could control their digital identities securely.

- Helps banks comply with Know Your Customer (KYC) regulations.

6. Blockchain in Insurance

- Smart contracts automate insurance claims.

- Reduces fraud and speeds up claim processing.

- Ensures transparency in policy agreements.

7. Blockchain in Supply Chain Finance

- Enhances transparency in trade finance transactions.

- Ensures secure payments between buyers and suppliers.

- Reduces paperwork and processing time.

8. Blockchain in Credit Scoring

- Decentralised credit scoring systems improve financial access.

- Eliminates bias in traditional credit checks.

- Enables more people to get loans based on real financial activity.

How Blockchain Will Reshape the Digital Economy

Blockchain is transforming finance by making transactions faster, safer, and more transparent. It reduces fraud, removes middlemen, and improves access to financial services. However, challenges like regulation and security risks remain.

Blockchain will likely play a bigger role in the global economy as it evolves. Businesses and individuals should stay informed about its developments. The future of finance is digital payments, and blockchain is leading the way.

With ongoing improvements and growing adoption, blockchain technology will continue to reshape the financial world. It offers endless possibilities for efficiency, security, and financial innovation. Those who embrace it early will have a competitive advantage in the evolving digital economy.